How To Get Wells Fargo Student Credit Card In 2022

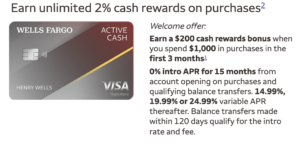

This article will examine the features of the Wells Fargo student credit card, fees incurred, and how to get one in 2022. The Wells Fargo student credit card stands amongst its plethora of quality credit cards. The top Wells Fargo credit cards provide competitive cashback, points, and/or consumer-friendly features such as no annual fees (or annual costs that may be justified based on incentives), introductory interest rates, and one-time bonuses.

Wells Fargo provides cards for a variety of market sectors, including consumers, students, and small business owners who want to earn and redeem rewards in a variety of ways. Because of its attractive cash back rewards structure on popular spending categories over the first six months, the Wells Fargo Cash Back College Student card is the finest student card from Wells Fargo.

You will continue getting a limitless 1% cashback on every transaction once the promotional offer ends. Because there is no annual charge, this card is a fantastic place to start building credit in college before upgrading to a higher Wells Fargo rewards card after graduation.

Wells Fargo Student Credit Card Features

The variable purchase APR on the Wells Fargo Cash Back College Card ranges from 11.15 percent to twenty-one percent. The cards have a variable stability transfer APR ranging from 11.15 percent to 21.15 percent. And allows you to use the available credit on one credit card to pay down the debt on one or more credit lines or loans. While setting up a balance transfer may be advantageous to an individual, balance transfers may be subject to restrictions and/or costs, so you should review your account agreement before proceeding.

Please keep the following in mind if you want to link your accounts in your Wells Fargo checking account for Overdraft Protection. An Overdraft Security Advance Fee may be charged to your account each day an Overdraft Protection Advance is issued, and interest will accumulate from the date each increase is made, according to your account conditions. Your credit card must be active; else, no funds will be sent to cover the overdraft.

When the recipient’s email address or U.S. mobile account is already enrolled with Zelle, transactions are typically completed in minutes. Almost everyone with a bank account in the United States can get it. Zelle should only be used to send money to close friends, family, or anyone you trust for security reasons. The Request function in Zelle is currently only available through Bore holes Fargo on a smartphone, and it may not be available for all small business accounts at this time. A U.S. mobile phone number must be enrolled with Zelle for payment requests to be delivered to it.

Wells Fargo student Credit Card fees and rewards

Purchases made through third-party transaction accounts, online marketplaces, stores that submit purchases using a mobile or wireless card reader, or when you use a new mobile or electronic mobile currency may not receive bonus points. For every $1 spent on other net purchases, one benefit point will be awarded. The benefits of this credit card will pique your attention. It has several appealing aspects that will entice you to apply for the card. In this section, I’ve drafted some of the features to show you. Some of it is seen below:

- For the first six months, earn additional cashback on petrol, groceries, and pharmacy purchases.

- When you pay your monthly payment using the Wells Fargo Cash Back College Card, you may protect your phone from damage or theft.

- Roadside support, vehicle rental accident damage waiver, travel and emergency assistance services, zero liability protection, and EMV chip technology are just a few of the extras available. Access your FICO® Credit Score and use budgeting and monitoring tools to keep on top of your money.

- Receive email or text message warnings when your credit limit is approaching or when a payment is due.

- Redeem for statement credits, travel, gift cards, charitable donations, merchandise, and digital rewards by depositing cash into your Wells Fargo savings account, requesting a paper check, withdrawing from a Wells Fargo ATM, or redeeming for statement credits, travel, gift cards, charitable donations, merchandise, and digital rewards.

When mobile phone charges are paid using a Wells Fargo student credit Card, Wells Fargo Business Credit Card, Wells Fargo Commercial Card, or a credit card that is linked to a Personal credit line, the coverage does not apply. Mobile phones that are rented, borrowed, or even received as part of a prepaid cellular plan are not covered. Electronic failures or faults with the device’s software will not be covered. This coverage may or may not be equal to, or even superior to, other available options.

However, if you pick a new product and complete your application on a lending partner’s website, they may request your complete credit report from one or more consumer reporting agencies, which is referred to as a hard credit pull and may have an impact on your credit. Third-party products, services, websites, suggestions, endorsements, and reviews are not within the control of SuperMoney.

How to Make the Most of Your Wells Fargo Credit Card

Sign up for account reminders, budgeting, and monitoring features on the Wells Fargo Cash Back College Card if you’re a college student trying to create a responsible credit history. You may also set up recurring monthly payments to the card to avoid paying expensive late penalties. Make sure you can pay off the debt within the six-month intro period to get the most out of the 0% APR on purchases and balance transfers.

Your normal APR might go as high as 23.15 percent once the intro period finishes, which can rapidly build up and deplete your cashback incentives. When you pay your monthly account with your Wells Fargo card, you’ll get up to $600 in free cell phone protection. According to a 2014 survey by Baylor University researchers, college students spend between eight and ten hours a day on their phones, thus this feature will come in useful if you have a history of dropping your phone.

Finally, for the first six months, all of your petrol, supermarket, and pharmacy purchases on the card to earn up to $2,500 in cashback. After that, all purchases get just 1% cashback.

How To Get A Wells Fargo Student Credit Card In 2022

You’ll need an existing Wells Fargo bank account to apply for this card online. If you don’t already have a Wells Fargo account, you’ll need to apply in person at a Wells Fargo branch. If you are under 21 and do not have verifiable income, you will need a co-signer who is over 21 and can produce evidence of income. Your Social Security number, government-issued identification, and information about the institution where you’re enrolled will all be required on the application. If you’re not sure how to apply for the Wells Fargo student credit card online, the instructions below will help you:

- To apply, go to the Wells Fargo website and click the “Apply Now” box.

- Fill in your Wells Fargo information if you have it; if you don’t, you can still finish your application by providing some personal and financial information. Details requested include:

- First and last name

- Address

- Social Security number

- Email and phone number

- Date of birth

- Mother’s maiden name

- Country of citizenship

- Housing status

- Monthly mortgage or rent payment

- Employment status and occupation

- Employer name and phone number

- Years at current employer

- Total annual income

- Is any portion of your income non-taxable?

- Finally, double-check your information before submitting it.

When you have finished applying for this card, you can wait for the card issuer to make a final decision. This is about all there is to it when it comes to applying for the Wells Fargo student credit card. The procedures are straightforward.

How does the Wells Fargo Student Credit Card compare to other credit cards?

Before applying for a new credit card, you should carefully consider all of your alternatives. Below, we compare the Wells Fargo student credit Card to several other excellent student credit cards:

Wells Fargo Cash Back College Card vs. Discover it Student Cash Back

It’s no wonder that the Discover it® Student Cash Back card is among the most popular among students. If you don’t have a strong relationship with Wells Fargo, we recommend the Discover it® Student Cash Back. The one drawback with Discover is that it isn’t as widely recognized as the Vista-based Wells Fargo Cash Back College Card. The Discover it® Student Cash Back rewards program is considerably superior. Cardholders get 5% cashback on daily purchases at various locations each quarter, such as Amazon.com, grocery shops, restaurants, petrol stations, and when paying with PayPal, up to the quarterly maximum when you activate, and 1% limitless cashback on all other transactions – automatically.

Wells Fargo Cash Back College Card vs. Journey Student Rewards from Capital One

For those who always pay their balance in full, Capital One’s Journey Student Rewards is a superior option. You may get 1% Cash Back on all purchases with the card, plus a 0.25 percent Cash Back bonus on the cashback you earn every month you pay on time. In the long term, that’s a better deal than the Wells Fargo Cash Back College Card’s rewards rate. This card is especially appealing to students studying abroad or who travel frequently because there are no international transaction fees on purchases made outside the US.

This is a one-of-a-kind feature that many other student cards lack. While there is no sign-up incentive, Capital One’s Journey Student Rewards program does provide a $60 streaming subscription credit. When you pay on time for a year on some streaming services, you might receive $5 every month. When you look at the card’s APR, it falls short: there is no 0% promotional APR for all cardholders, and the APR is excessively high at 26.99 percent (Variable).

On the other hand, with the Wells Fargo Cash Back College Card, you get a 0% initial APR on purchases for six months, after which your APR will fluctuate between 11.15 percent and 21.15 percent. However, if you are confident in your capacity to pay your account in full and keep track of your spending, we recommend Capital One’s Journey Student Rewards.

Wells Fargo Cash Back℠ College Card vs. Deserve® EDU Mastercard for Student

The Deserve® EDU Mastercard for Students is the finest card for overseas students or those who do not have a Social Security number. This is one of the few credit cards that don’t require you to have a Social Security number to register. In the short term, the Deserve® EDU Mastercard for Students offers somewhat lower rewards than the other cards. Cardholders will get 1% unlimited cash back on ALL transactions – unlike the Wells Fargo Cash BackSM College Card, there is no initial bonus on petrol, groceries, or pharmacy purchases.

The Deserve® EDU Mastercard for Students has a few appealing features, including no international transaction fees and a one-year free Amazon Prime student subscription. If you don’t have a Social Security number, you should instead apply for the Wells Fargo Cash BackSM College Card.

Credit Management Tools for First-timers

If you’re a student, this is almost certainly your first credit card. For first-time card users, Wells Fargo also provides essential credit and budget management tools, such as My Money Map and the opportunity to examine your FICO credit score. My Money Map is an exclusive Wells Fargo software for tracking your spending, including features like My Spending Report, Budget Watch, and My Savings Plan. My Spending Report is a sophisticated money management application that creates graphs to help you visualize your spending habits.

Budget Watch shows you where your accounts stand and lets you set alerts for them, so you’ll know when you’ve hit a specific spending level, for example. My Savings Plan, on the other hand, keeps track of your progress toward your savings objectives. Finally, after a few months of card use, you’ll be able to see your FICO Score via your Wells Fargo app or desktop sign-on.

These tools might be extremely beneficial to those who are new to credit and are concerned about spending more than they can spare. Log in to your Wells Fargo Online account and click on the “Plan & Learn” page to access any of these tools.

The Wells Fargo Student Credit Card is Right for You if:

One of the few student credit cards with a 0% introductory APR is the Wells Fargo Cash Back College Card. This makes it an excellent option for college students who want to finance a significant purchase or who already have credit card debt. Students who want to take advantage of the card’s cell phone protection and travel services should put it on their shortlist because there aren’t many student credit cards that provide these benefits.

It does provide a chance for college students to earn prizes while accumulating credit. However, students looking to maximize their credit card benefits may prefer a student credit card that keeps the points-earning rate on bonus categories after the promotional period ends. When it comes to accumulating rewards, college students, as well as credit card users in general, should avoid pursuing the most points if doing so may lead to credit card debt.

A student credit card is first and foremost a tool to aid in the development of respectable credit history, and the Wells Fargo Cash Back CollegeSM card may assist you in this endeavor while also providing some small benefits.

History of Wells Fargo?

Wells Fargo is one of the country’s oldest financial institutions, having been founded in 1852 in California by the same founders of American Express—Henry Wells and William Fargo—to capitalize on the burgeoning gold rush that began in 1848. Wells Fargo is now a big bank with coast-to-coast activities and well over $1 trillion in assets, thanks to various mergers and acquisitions over the years, including Crocker National Bank, Norwest, and Wachovia. In terms of outstanding balances, its credit card operations are ranked eighth in the United States, just below Discover.

How Good Is Wells Fargo Customer Service?

In the J.D. Power 2020 U.S. Credit Card Satisfaction Study, Wells Fargo was placed eighth out of 11 national card issuers. The bank obtained a lower-than-average rating. 1 Some of Wells Fargo’s dissatisfaction may stem from the bank’s retail banking debacle, in which the firm was forced to make reparations for creating millions of accounts on behalf of clients without their authorization. The financial behemoth is now under new leadership, so only time will tell if customer service rates improve.

Wells Fargo’s great customer service can be contacted through phone or online. All questions are efficiently handled by their knowledgeable personnel. Customer care is accessible 24 hours a day, 7 days a week, and cardholders may check their credit and cash rewards balances online or by calling the number shown above. There is also an online student community where students may get answers to their questions regarding the card and ask them.

How to Increase Your Chances of Getting Approved for a Wells Fargo student Credit Card

Getting authorized for a credit card takes some effort. The majority of credit card offers necessitate excellent credit. When applying for new credit, knowing your credit scores and what’s on your credit reports is critical. Issuers of credit cards want to see a good credit history, consistent income, and minimal credit use. It’s a hint that you may not be able to repay your existing revolving credit if you’re using too much of it.

You could also check to see whether you’ve applied for too much credit recently. Having too many credit queries might make it more difficult to be accepted.

Conclusion

The Wells Fargo Cash Back Credit Card is a good option for college students who wish to receive rewards for their shopping while building a good credit history. It’s especially useful for students who spend enough in the first six months of their account to receive up to $50 in extra cashback on petrol, groceries, and pharmacy purchases. Furthermore, because there is no annual fee and a 0% intro APR on purchases and balance transfers, you may earn points without paying additional fees or interest.

However, if you’re an excellent student who doesn’t mind putting in a little more effort, the Discover it Student Cash Back® card could be worth considering. The Discover it card is a worthy contender and one of the most attractive student cards on the market, offering 5% rewards in rotating bonus areas every quarter, automatic cashback match after your first year, and a $20 bill credit each year your GPA is 3.0 or better.

Frequently Asked Questions

Does Wells Fargo offer student credit cards?

The Wells Fargo Cash Back College card is a good option if you’re searching for a student credit card with no annual fee, at least for the first six months. During that time, you’ll get 3% cash back on eligible purchases up to $2,500 in total.

What is the limit on Wells Fargo student credit cards?

The Wells Fargo Cash Back College card normally has a credit limit of $500 to $2,000 or more. The credit limit is set by Wells Fargo based on the cardholder’s creditworthiness. Credit limits on this card are often lower than those on other credit cards because it is a student card.

Does applying for a credit card hurt your credit?

Applying for a credit card and getting refused can be aggravating, especially if you’re concerned about your credit score being affected. Instead, asking for a credit card will result in a hard inquiry, which will drop your credit scores usually by a few points, according to credit-scoring corporation FICO®.

What is the highest credit limit for Wells Fargo?

Minimum credit card limits for Wells Fargo credit cards range from $500 for the Wells Fargo Cash Back CollegeSM Card to $5,000 for the Wells Fargo Visa Signature® Card. Other Wells Fargo cards are in the middle of the pack.

What credit card do billionaires use?

The American Express Centurion Card, sometimes known as the “Amex Black Card,” is the world’s most exclusive credit card. Since its inception in 1999, American Express has been shrouded in mystery, giving it a high level of status in the minds of consumers.

COPYRIGHT WARNING! Contents on this website may not be republished, reproduced, redistributed either in whole or in part without due permission or acknowledgment. All contents are protected by DMCA.

The content on this site is posted with good intentions. If you own this content & believe your copyright was violated or infringed, make sure you contact us at [xscholarshipc(@)gmail(dot)com] and actions will be taken immediately.